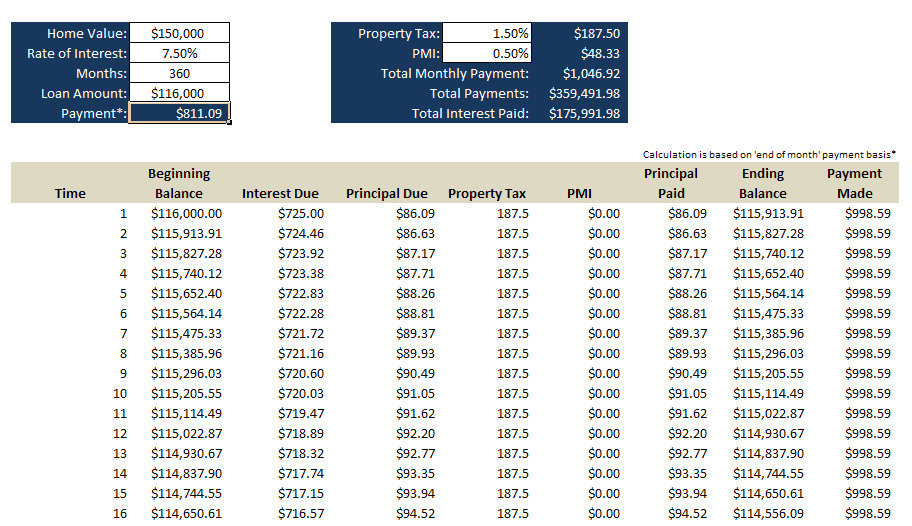

Here are some tips for using the calculator: The payment will include principal, interest, property taxes, and homeowners insurance. Once you have entered this information, the calculator will estimate your monthly mortgage payment. & maintenance fees: The fees associated charged by a homeowners association (HOA).

#Mortgage calculator with taxes and insurance and hoa free#

It is a free and easy way to get an estimate of your monthly mortgage payment and can help you make a more informed decision about buying a home. If you are thinking about buying a home, we encourage you to use a mortgage payment calculator.

This information can help you avoid financial stress down the road.

You will have a better understanding of your monthly mortgage payment and how much you can afford to spend on a home. By using a mortgage payment calculator, you can make a more informed decision about buying a home. Make a more informed decision about buying a home.This can be a valuable tool when you are making an offer on a home, as it shows the seller that you are serious about buying. This will give you a letter from a lender stating how much money you are qualified to borrow. Once you have a good idea of how much house you can afford, you can get pre-approved for a mortgage. You can also use the calculator to compare different loan terms and interest rates, so you can find the best deal on your mortgage. By getting an estimate of your monthly mortgage payment before you start shopping for a home, you can avoid wasting time looking at homes that are out of your price range. Using a mortgage payment calculator can save you time and money in the long run. This information can help you narrow down your search to homes that are within your budget.

By entering your income, down payment, and interest rate into the calculator, you can get an estimate of your monthly mortgage payment. One of the most important benefits of using a mortgage payment calculator is that it can help you determine how much house you can afford. Determine how much house you can afford.Here are some of the benefits of using a mortgage payment calculator: This information can help you determine how much house you can afford and make a more informed decision about buying a home. A mortgage payment calculator can help you estimate your monthly payment based on your income, down payment, and interest rate. Buying a home is a big decision, and one of the most important things to consider is your monthly mortgage payment.

0 kommentar(er)

0 kommentar(er)